Income Tax Slabs FY 2025–26 have been updated under the new tax regime, offering greater relief and simplified compliance for Indian taxpayers. As announced in the Union Budget 2025, the basic exemption limit has been raised, and a progressive tax structure has been introduced. This change benefits salaried individuals, small business owners, and pensioners—especially those preferring a hassle-free tax filing experience

Whether you’re a salaried employee, a small business owner, or a pensioner, understanding these changes can help you plan your finances more effectively. Let’s explore what’s new and how you can make the most of it.

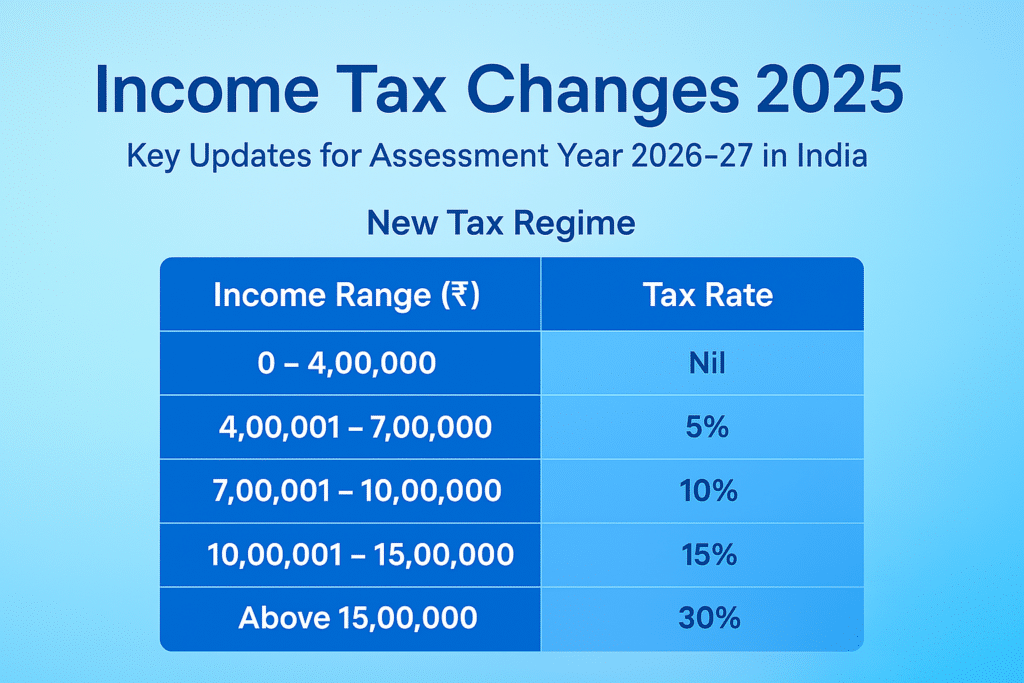

Revised Income Tax Slabs for FY 2025–26 (New Regime)

The Income Tax Slabs FY 2025–26 under the new regime are as follows:

Income up to ₹4,00,000 – Nil

₹4,00,001 to ₹8,00,000 – 5%

₹8,00,001 to ₹12,00,000 – 10%

₹12,00,001 to ₹16,00,000 – 15%

₹16,00,001 to ₹20,00,000 – 20%

₹20,00,001 to ₹24,00,000 – 25%

Above ₹24,00,000 – 30%

The increase in the exemption limit from ₹3 lakh to ₹4 lakh reflects the government’s intent to ease the tax burden, particularly for middle- and lower-income taxpayers. The progressive nature of the slab structure ensures that taxpayers contribute based on their ability to pay, without overcomplicating the process.

Impact of the New Income Tax Slabs

The new slab structure offers reduced tax liability for many individuals who do not claim several deductions. Here’s a quick illustration:

Suppose your taxable income is ₹9,00,000. Your tax will be calculated as follows:

5% on ₹4,00,001 to ₹8,00,000 = ₹20,000

10% on ₹8,00,001 to ₹9,00,000 = ₹10,000

Total Tax Payable: ₹30,000

This simple structure benefits those looking for a no-fuss approach to tax filing. Compared to the old regime, especially for those not using many deductions, this could result in significant savings.

Old vs. New Regime: What Should You Choose?

While the Income Tax Slabs for FY 2025–26 are appealing, the choice between the old and new regime depends on your financial profile:

Choose the New Regime If You:

Prefer a simple return filing process

Don’t claim major deductions like HRA, 80C, or home loan interest

Want lower tax rates without documentation hassles

Stick with the Old Regime If You:

Have significant investments in tax-saving instruments (PPF, ELSS, life insurance)

Pay housing loan interest or children’s tuition fees

Claim multiple exemptions such as HRA, LTA, and Section 80 deductions

Tip: Use a tax comparison calculator or consult professionals like A Z R Consulting to determine the most suitable regime for you each year.

Tax Planning Tips for FY 2025–26

Even if you opt for the new regime, smart tax planning remains important:

Compare both regimes annually before filing

Keep documentation ready, especially Form 16 and investment proofs

If salaried, optimize your salary structure (e.g., claim reimbursements)

File returns on time to avoid penalties and maintain a clean tax record

Leverage Section 87A rebate – If your taxable income is up to ₹7 lakh under the new regime, your tax liability becomes zero

Planning early can help avoid the last-minute rush and minimize errors in return filing.

Rebate and Exemption Highlights for FY 2025–26

Section 87A Rebate: For total income up to ₹7 lakh, no tax is payable under the new regime

Standard Deduction: ₹50,000 for salaried individuals and pensioners remains applicable under both regimes

Leave Travel Allowance (LTA): Not allowed under the new regime

HRA and 80C Benefits: Applicable only under the old regime

It’s important to note that under the new regime, most deductions are not applicable, which simplifies the process but also reduces flexibility in tax saving.

Conclusion: Make the Right Tax Choice for 2025–26

The updated Income Tax Slabs for FY 2025–26 are aimed at simplifying tax compliance and ensuring greater financial relief for honest taxpayers. Whether you opt for the new or old regime, the key is to make an informed choice tailored to your financial situation.

At A Z R Consulting, we help you assess your income, structure your salary, evaluate deductions, and file with complete confidence. Don’t let tax season stress you out — get expert advice and file smarter this year.